Market Structure

Reading the price action and determining the market trend.

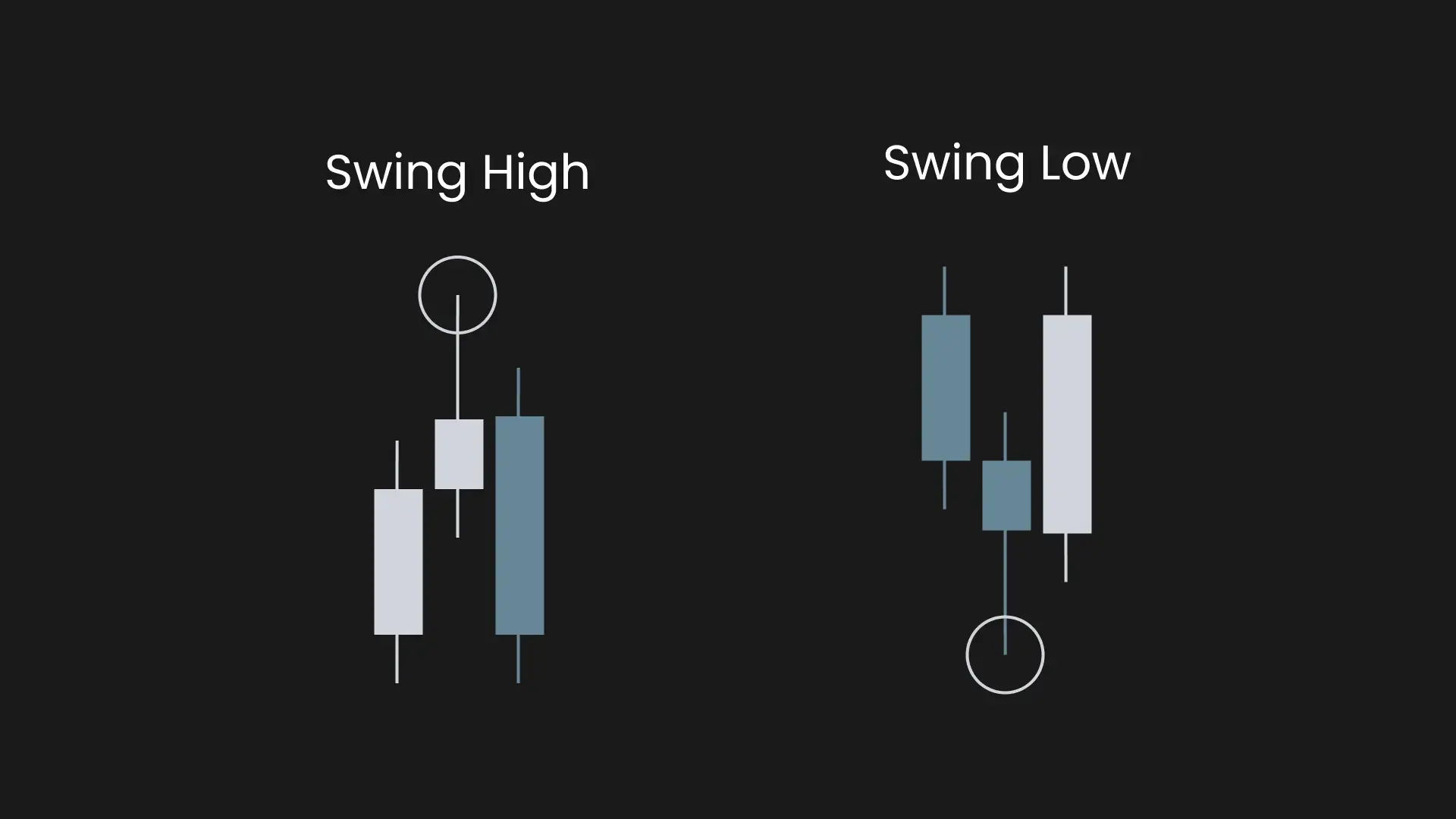

Swing High and Low

Swing High and Swing Low are three-candle patterns where the middle candle has the highest high or lowest low.

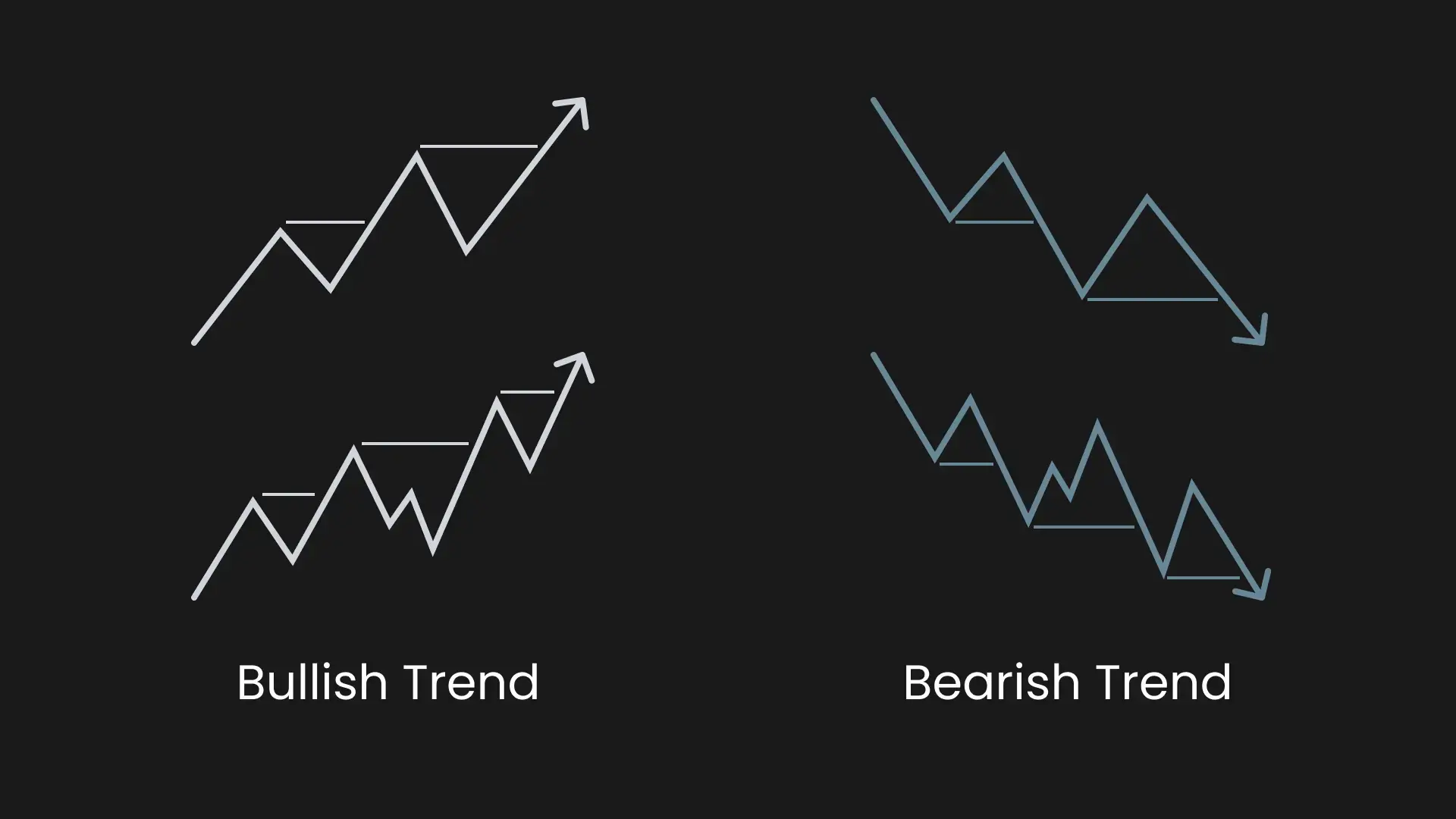

Trends

To determine the market trend, we focus on the latest price leg between the most recent Swing High and Swing Low.

Minor moves in between are ignored unless price closes above the Swing High or below the Swing Low, signaling a possible continuation or reversal.

A bullish trend is made of higher highs and higher lows.

A bearish trend is made of lower highs and lower lows.

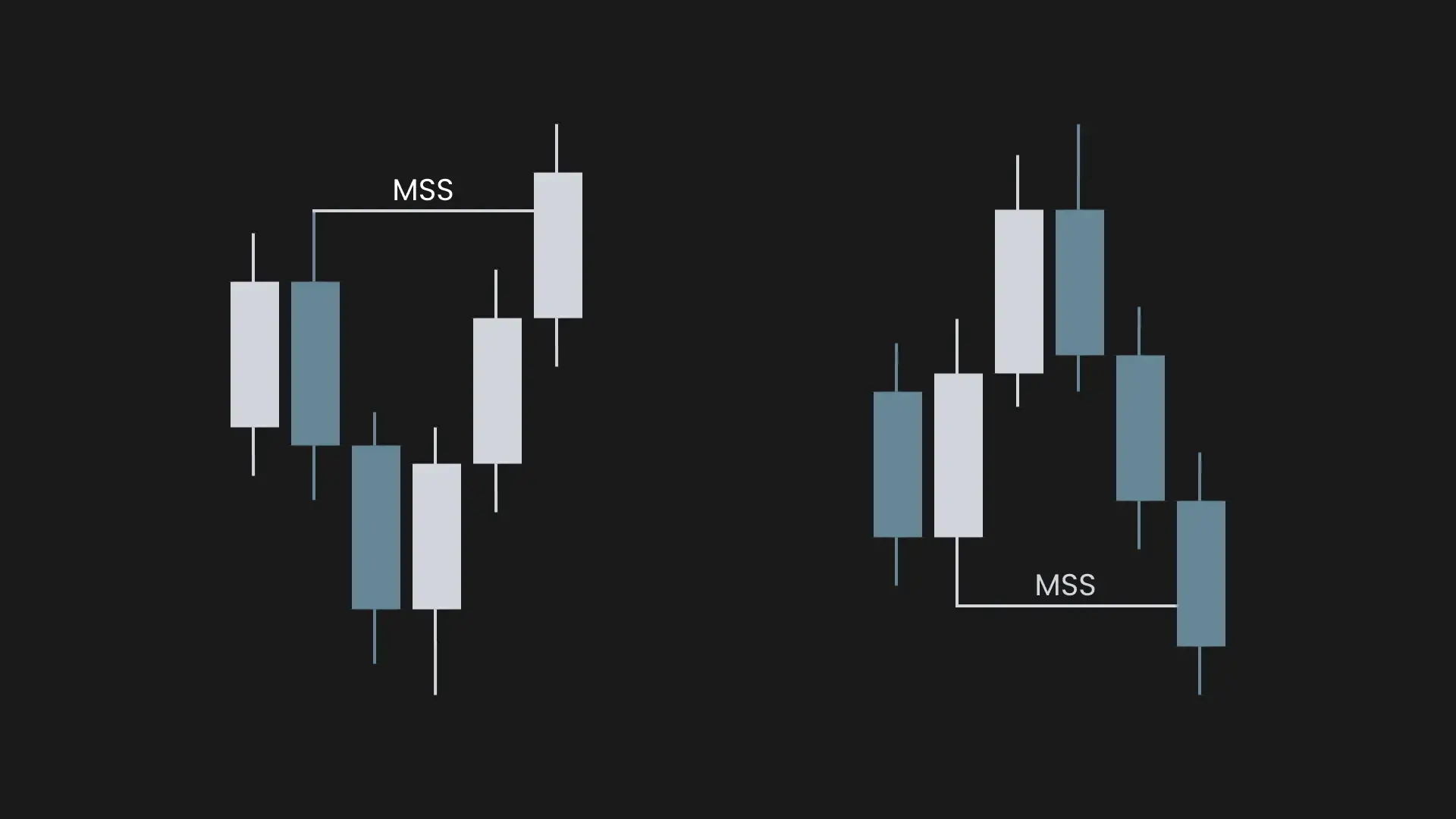

Market Structure Shift (MSS)

A Market Structure Shift (MSS) occurs when a candle body closes above a previous Swing High or below a Swing Low, signaling a potential trend reversal.

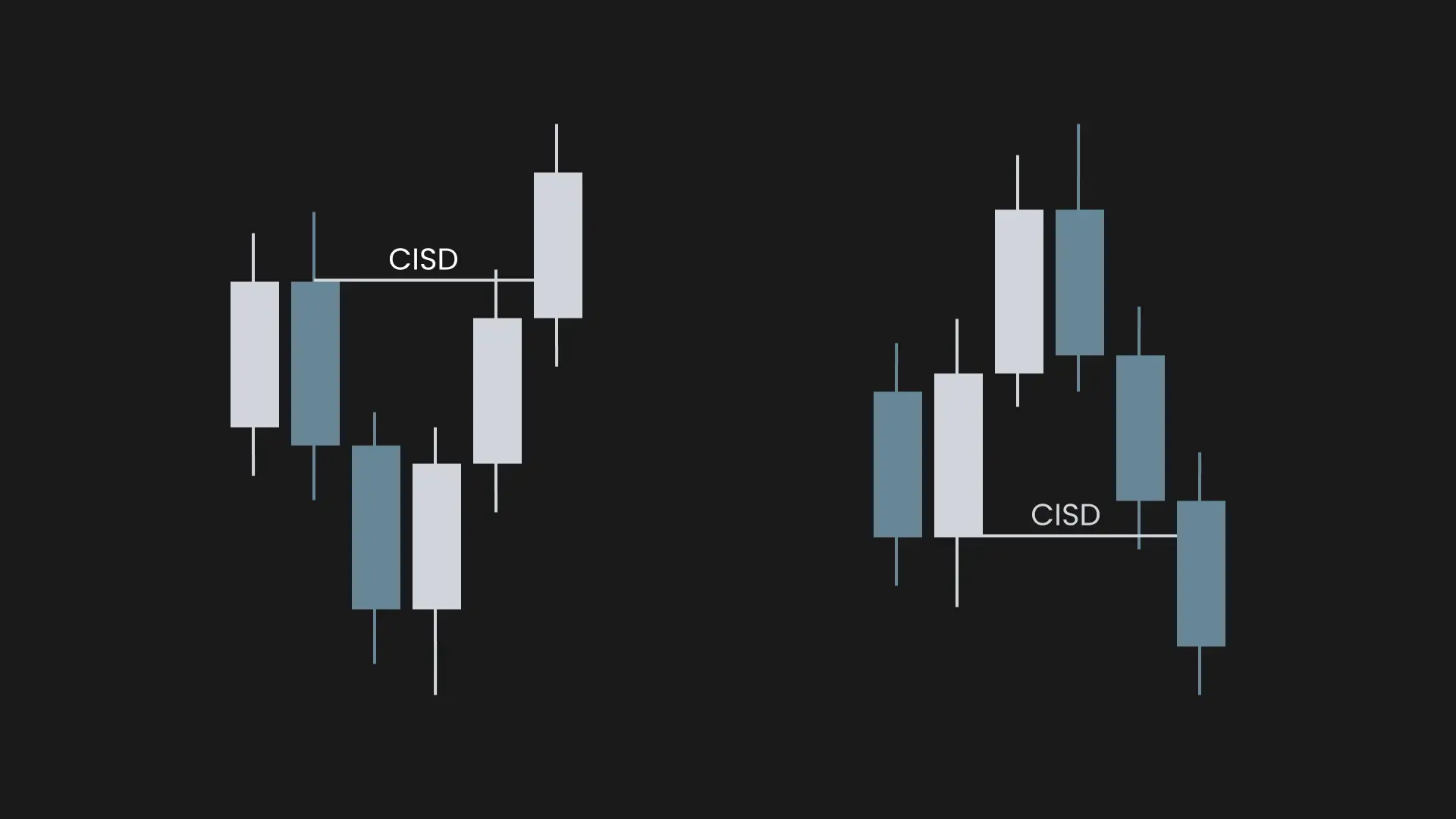

Change in State of Delivery (CISD)

A Change in State of Delivery (CISD) is defined as a closure above the body of a series of down-closed candles or below the body of a series of up-closed candles.

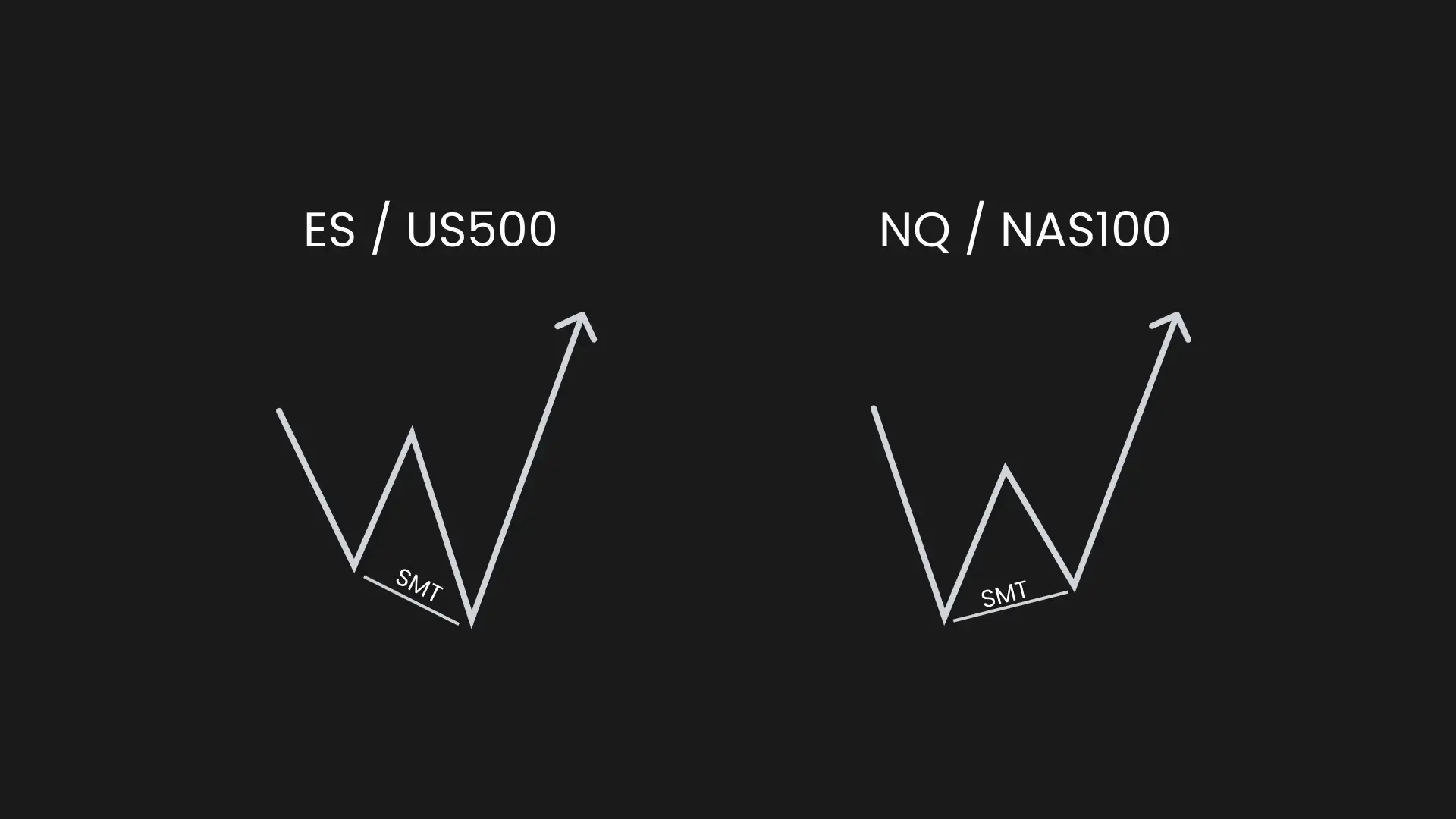

SMT Divergence

Smart Money Technique (SMT) Divergence occurs when price action diverges between correlated instruments, indicating potential smart money involvement or a possible reversal.

Correlated Instruments

- NQ and ES

- EURUSD and GBPUSD

- Gold and Silver

- and others...