Liquidity

The reason why the market moves.

Price moves due to three core factors:

- generate liquidity

- hunt liquidity

- offer fair value via PD Arrays

- rebalance imbalances and inefficiencies

- rebalance equilibrium

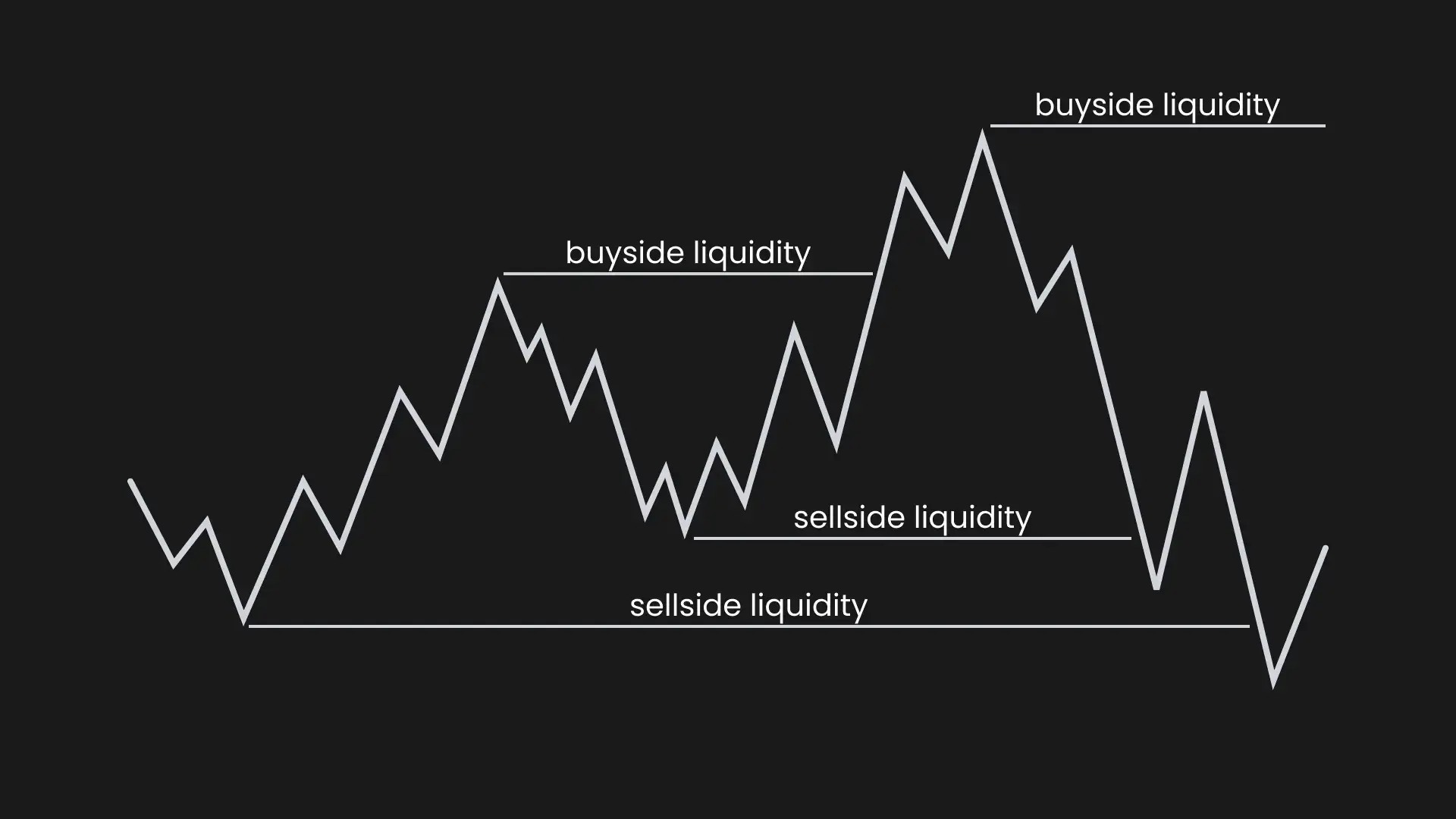

Buyside & Sellside Liquidity

Resting buy and sell orders above swing highs and lows represent liquidity.

Big players use this liquidity to fill large positions by taking the opposite side, minimizing price impact.

As a result, markets often reverse at these levels.

A Draw on Liquidity (DOL) is the current liquidity pool towards which the market is headed.

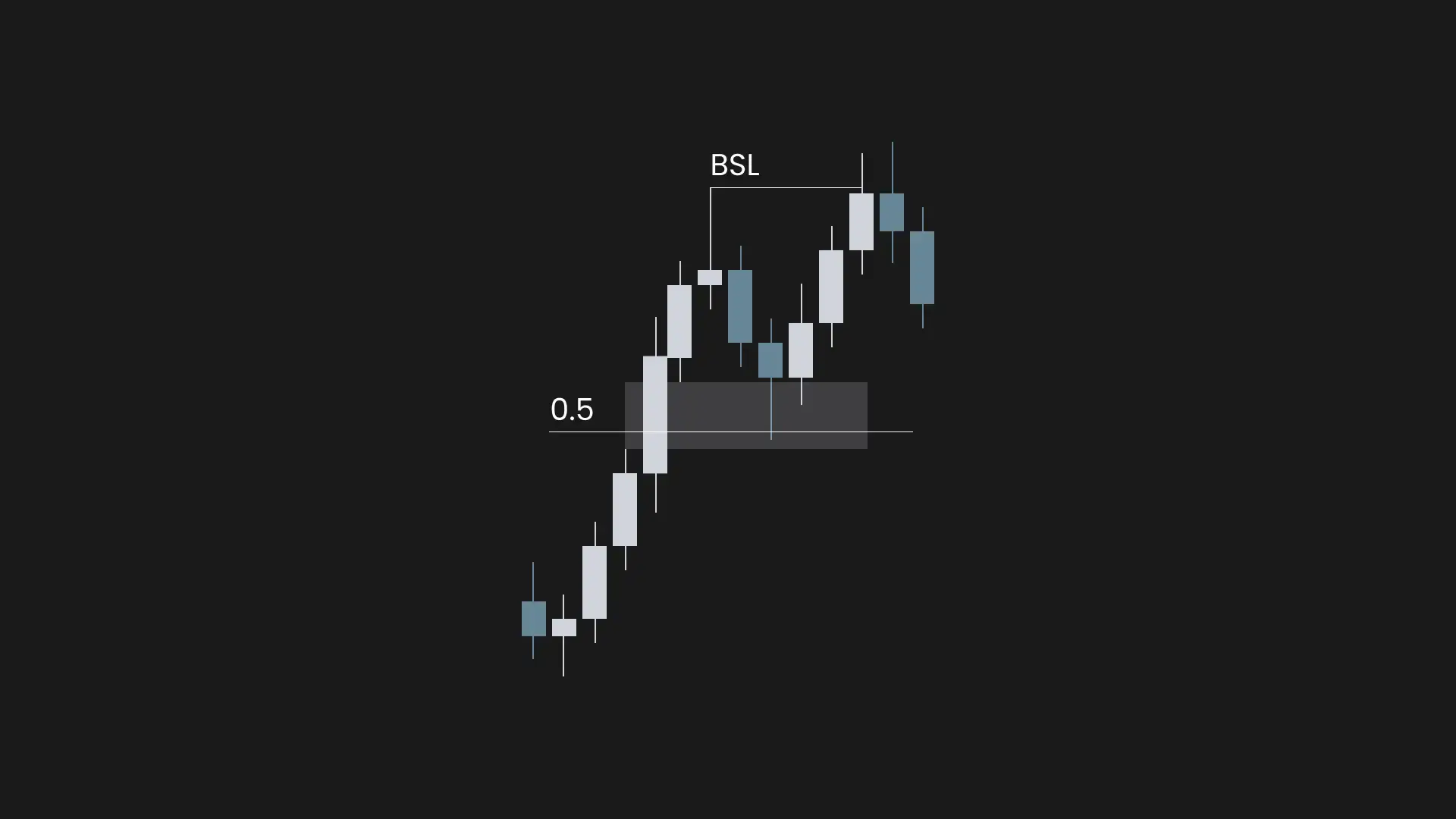

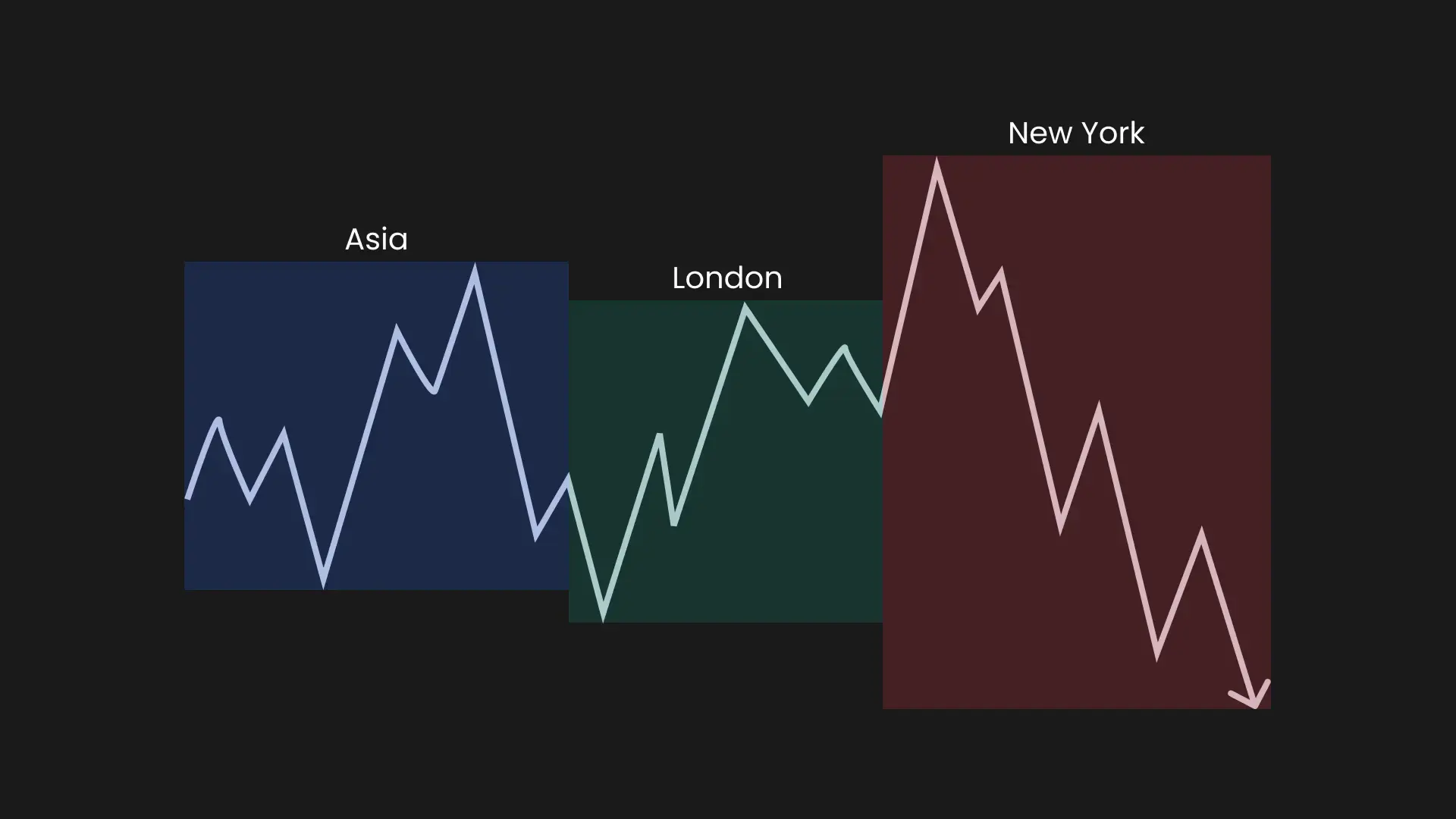

Time-based Liquidity

Session-based liquidity is defined by the high and low of a trading session (Asia, London, or New York).

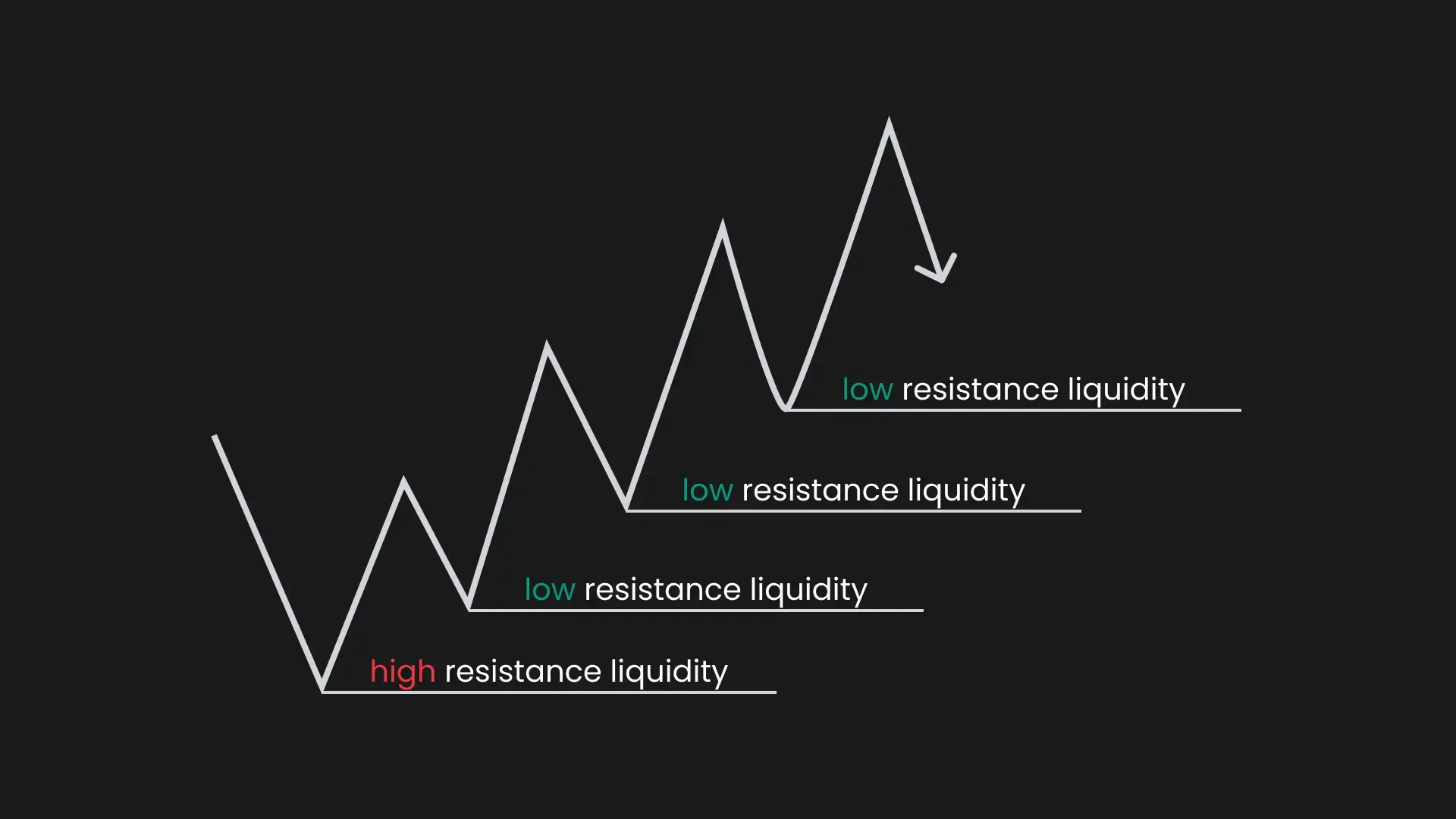

Low & High Resistance Liquidity Run

Low Resistance Liquidity

When price struggles to sweep liquidity, it leaves many untapped pools, creating more liquidity and setting up a stronger future draw that price can break through easily.

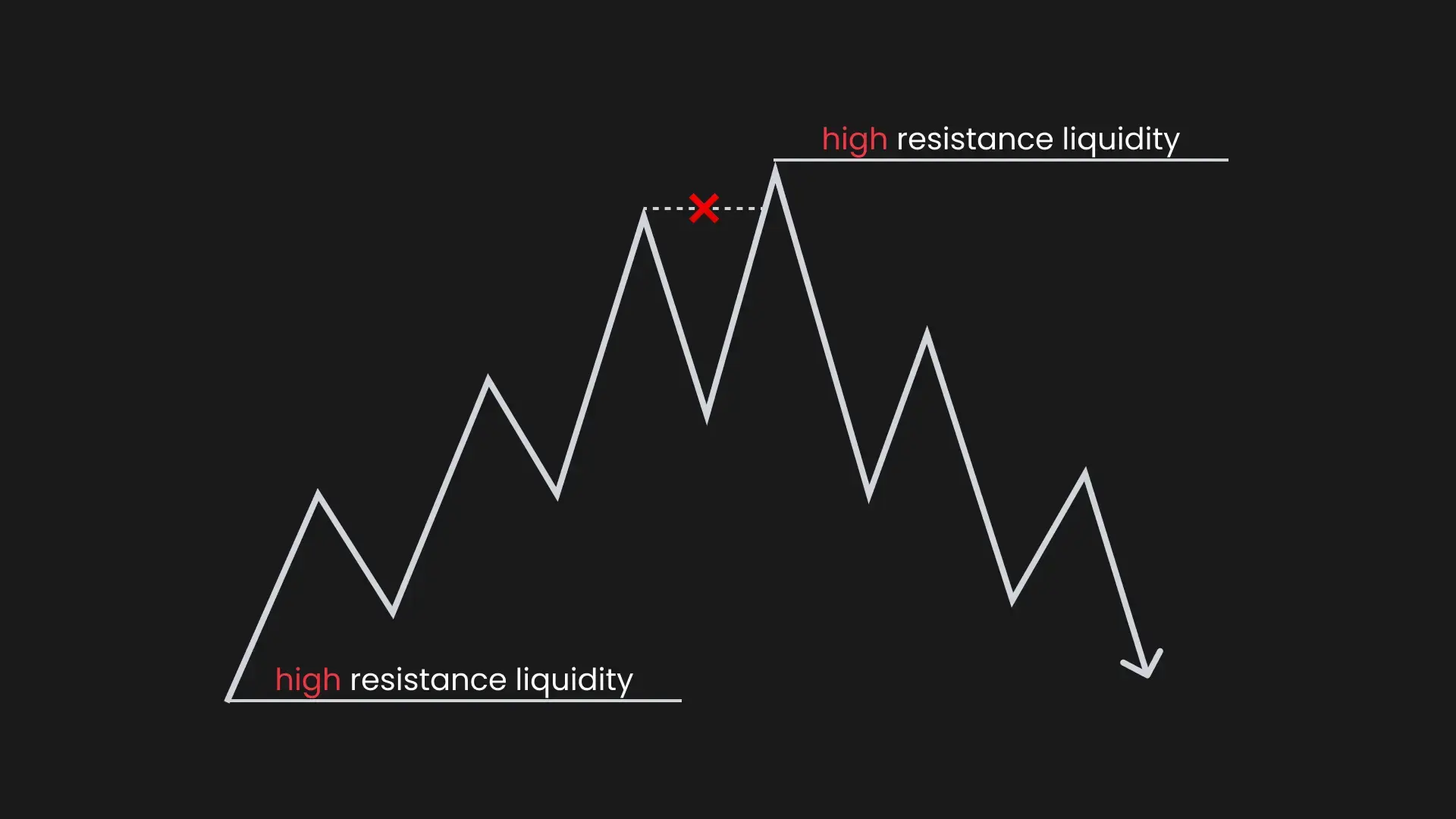

High Resistance Liquidity

A Failure Swing defines a high-resistance liquidity.

It occurs when price fails to close above swept liquidity and then begins to reverse, creating a Protected High / Low.